Everything You Need to Know About Consolidation Loans

Consolidation loans are a great way for individuals and businesses to combine their various debts into one single loan or debt repayment plan, allowing them to manage the entire process more easily. In French, this is known as “regroupement crédit ”. The idea behind this form of loan consolidation is that it allows the borrower to reduce their overall debt load as well as reduce their interest rate, making it easier to pay down the total balance more quickly.

The Benefits of Consolidation Loans

There are several benefits associated with taking out a consolidation loan, including the following:

- Pay off debt faster – consolidating your debts can make it easier to pay them off faster.

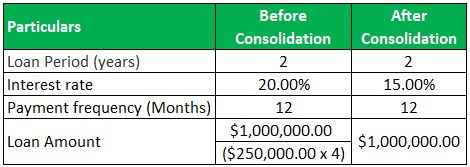

- Reduced interest rates – as long as you get a lower rate on the loan, you can reduce the amount of interest you’re paying overall.

- Easier to manage – since you’ve combined all of your debts into one loan, it makes tracking payments and other information much simpler.

- Fewer payments to keep track of – instead of having to remember multiple payment due dates, you only need to worry about one payment per month.

Types of Consolidation Loans

There are two main types of consolidation loans: secured and unsecured. A secured loan requires some form of collateral, such as a house or car, while an unsecured loan does not require any kind of collateral. Each type of loan has its own pros and cons, so it’s important to understand the differences before committing to a loan.

Choosing a Consolidation Loan

When selecting a consolidation loan, you should take into account the amount of money you’ll need to borrow, the interest rate, the length of the loan, and the repayment terms. It is important to compare different lenders, as they may offer different rates and repayment rules. Additionally, it’s a good idea to shop around for the best deals in order to find the right loan for your needs.

What to Watch Out For

It is also important to watch out for potential risks when applying for a consolidation loan. If you don’t have a strong credit score, it might be difficult to qualify for a low-interest loan. Additionally, if you miss a payment or default on the loan, it could damage your credit score even further. Lastly, if you choose a loan with higher interest rates, it could end up costing you more in the long run.

Conclusion

In conclusion, consolidation loans can provide a great opportunity for individuals and businesses to pay off their debt faster and at a lower cost. However, it is important to do research and consider the risks associated with these types of loans before committing to one. Taking the time to understand what a consolidation loan entails can help you find the best option for your situation, so you can ultimately save money in the long run.